加密貨幣行業,這個建立在讓政府貪婪之手遠離人民貨幣原則上的機構,正在蓬勃發展。原因是什麼?他們可能終於說服政府接觸比特幣。 如您所見:比特幣的價格,自15年前由計算機代碼創造的OG數字資產,自選舉日以來已上漲超過30%,屢次打破歷史最高紀錄,並在撰寫本文時達到約92,000美元。自年初以來,價格已經翻倍,一些分析師預測到年底可能會達到100,000美元。 更廣泛的股市也在上漲,華爾街鬆了一口氣,因為美國選舉結果比預期更快、更明確地出爐。但加密貨幣通常與股票一起波動,往往有更高的高點和更低的低點,這就是為什麼人們喜歡在其上賭博。而本週,他們確實在賭博。 推動比特幣漲勢的熱潮主要集中在對當選總統唐納德·川普將推行親加密政策的期待上,使這個多年來被主流投資者階層忽視並遭到監管機構阻撓的行業獲得合法性。 “我們所看到的漲勢更多的是對加密領域市場動態正常化的反映,”Coinbase首席政策官Faryar Shirzad週二告訴我。“我認為我們所看到的是過去四年中我們面臨的政治逆風抑制了加密市場的真實、現場示範。” 川普在2021年曾表示加密貨幣“看起來像是一場騙局”,但今年早些時候對該行業做出了180度的轉變,這一明顯的心態變化恰逢該行業從2022年的災難性回落中反彈(部分原因是加密交易所FTX的崩潰以及其曾經高飛的創始人山姆·班克曼-弗里德的刑事起訴)。這一回升的一部分涉及Coinbase主導的政治動員,以及數千萬美元的加密利潤被投入到全國各地的各種競選中,使其成為2024年選舉周期中最大支出行業。 在夏季的一個大型比特幣會議上,川普向他的觀眾做出了兩個關鍵承諾:首先,他將解雇證券交易委員會主席Gary Gensler,後者是該行業的死敵。(從技術上講,總統無法解雇SEC主席,但Gensler被廣泛預期會辭職,這在新政府上任時是慣例。)其次:他將通過防止政府出售其在刑事案件中查獲的資產來創建一個國家比特幣儲備。 川普的第二個承諾有點模糊,也可能只是口頭上的,以避免被羅伯特·F·甘迺迪(Robert F. Kennedy Jr.)搶風頭,他在前一天承諾建立一個更雄心勃勃的“比特幣金庫”,使美國成為全球最大的比特幣持有者。 無論如何,結果基本上是相同的:美國政府將支持比特幣價格,而這一資產建立在政府不應操縱貨幣價值以適應其利益的理念之上。 記者本週詢問了幾位專家關於這種明顯與加密精神不一致之處。 “讓政府建立戰略儲備與許多意識形態方面完全不相容,而這些意識形態應該是關於去中心化和反權威主義,”記者和知名加密懷疑論者Molly White說。“但我認為一些加密貨幣愛好者認為‘好吧,這不是真的意識形態的一部分,但它讓價格上升。’” 更慷慨的看法可能是,在此時,加密貨幣唯一真正的用例是在創造可以進行交易和賭博的價值。或者正如彭博社的Zeke Faux上週所說,“用真實貨幣賭博虛構硬幣價格。” 從基本層面來看,“戰略儲備完全使比特幣作為一個具有全球系統意義的資產類別合法化,”范德堡大學法律教授兼副院長Yesha Yadav在電子郵件中表示。“這本身就代表了對於兩年前被認為已經死去的加密行業而言,一個巨大的象徵性勝利。”

加密貨幣行業,這個建立在讓政府貪婪之手遠離人民貨幣原則上的機構,正在蓬勃發展。原因是什麼?他們可能終於說服政府接觸比特幣。 如您所見:比特幣的價格,自15年前由計算機代碼創造的OG數字資產,自選舉日以來已上漲超過30%,屢次打破歷史最高紀錄,並在撰寫本文時達到約92,000美元。自年初以來,價格已經翻倍,一些分析師預測到年底可能會達到100,000美元。 更廣泛的股市也在上漲,華爾街鬆了一口氣,因為美國選舉結果比預期更快、更明確地出爐。但加密貨幣通常與股票一起波動,往往有更高的高點和更低的低點,這就是為什麼人們喜歡在其上賭博。而本週,他們確實在賭博。 推動比特幣漲勢的熱潮主要集中在對當選總統唐納德·川普將推行親加密政策的期待上,使這個多年來被主流投資者階層忽視並遭到監管機構阻撓的行業獲得合法性。 “我們所看到的漲勢更多的是對加密領域市場動態正常化的反映,”Coinbase首席政策官Faryar Shirzad週二告訴我。“我認為我們所看到的是過去四年中我們面臨的政治逆風抑制了加密市場的真實、現場示範。” 川普在2021年曾表示加密貨幣“看起來像是一場騙局”,但今年早些時候對該行業做出了180度的轉變,這一明顯的心態變化恰逢該行業從2022年的災難性回落中反彈(部分原因是加密交易所FTX的崩潰以及其曾經高飛的創始人山姆·班克曼-弗里德的刑事起訴)。這一回升的一部分涉及Coinbase主導的政治動員,以及數千萬美元的加密利潤被投入到全國各地的各種競選中,使其成為2024年選舉周期中最大支出行業。 在夏季的一個大型比特幣會議上,川普向他的觀眾做出了兩個關鍵承諾:首先,他將解雇證券交易委員會主席Gary Gensler,後者是該行業的死敵。(從技術上講,總統無法解雇SEC主席,但Gensler被廣泛預期會辭職,這在新政府上任時是慣例。)其次:他將通過防止政府出售其在刑事案件中查獲的資產來創建一個國家比特幣儲備。 川普的第二個承諾有點模糊,也可能只是口頭上的,以避免被羅伯特·F·甘迺迪(Robert F. Kennedy Jr.)搶風頭,他在前一天承諾建立一個更雄心勃勃的“比特幣金庫”,使美國成為全球最大的比特幣持有者。 無論如何,結果基本上是相同的:美國政府將支持比特幣價格,而這一資產建立在政府不應操縱貨幣價值以適應其利益的理念之上。 記者本週詢問了幾位專家關於這種明顯與加密精神不一致之處。 “讓政府建立戰略儲備與許多意識形態方面完全不相容,而這些意識形態應該是關於去中心化和反權威主義,”記者和知名加密懷疑論者Molly White說。“但我認為一些加密貨幣愛好者認為‘好吧,這不是真的意識形態的一部分,但它讓價格上升。’” 更慷慨的看法可能是,在此時,加密貨幣唯一真正的用例是在創造可以進行交易和賭博的價值。或者正如彭博社的Zeke Faux上週所說,“用真實貨幣賭博虛構硬幣價格。” 從基本層面來看,“戰略儲備完全使比特幣作為一個具有全球系統意義的資產類別合法化,”范德堡大學法律教授兼副院長Yesha Yadav在電子郵件中表示。“這本身就代表了對於兩年前被認為已經死去的加密行業而言,一個巨大的象徵性勝利。”

A version of this story appeared in CNN Business’ Nightcap newsletter.

The crypto industry, an institution founded on the principle of getting the government’s greedy hands off the people’s currency, is booming. The reason? They may have finally convinced the government to get its hands on bitcoin.

See here: The price of bitcoin, the OG digital asset created out of computer code 15 years ago, has shot up more than 30% since Election Day, repeatedly smashing its record high and peaking (as of this writing) at around $92,000. The price has more than doubled since the beginning of the year, and some analysts are projecting it could hit $100,000 by year-end.

The broader stock market is up, too, as Wall Street is breathing a sigh of a relief that the US election results came in faster and more decisively than expected. But crypto, which often moves in step with stocks, tends to have higher highs and lower lows, which is why people like to gamble on it. And boy are they gambling this week.

Much of the hype fueling bitcoin’s rally centers on expectations that President-elect Donald Trump will usher in a pro-crypto agenda, bestowing legitimacy on an industry that for years has been dismissed by the mainstream investor class and stonewalled by regulators.

“The rally that we’re seeing is more of a normalizing of what the market dynamic should be around the crypto sector,” Faryar Shirzad, chief policy officer at Coinbase, told me Tuesday. “I think what we’re seeing is a real, live demonstration of how much the political headwinds that we’ve been facing over the last four years have suppressed the crypto markets.”

Trump, who as recently as 2021 said crypto “seems like a scam,” did a 180 on the industry earlier this year, in an apparent change of heart that coincided with the sector’s rebound from its disastrous 2022 (marked in part by the collapse of crypto exchange FTX and the criminal prosecution of its once-high-flying founder, Sam Bankman-Fried). Part of that comeback involved a Coinbase-led political mobilization and tens of millions of dollars in crypto profits being funneled into various races around the country, making it the biggest-spending industry in the 2024 election cycle.

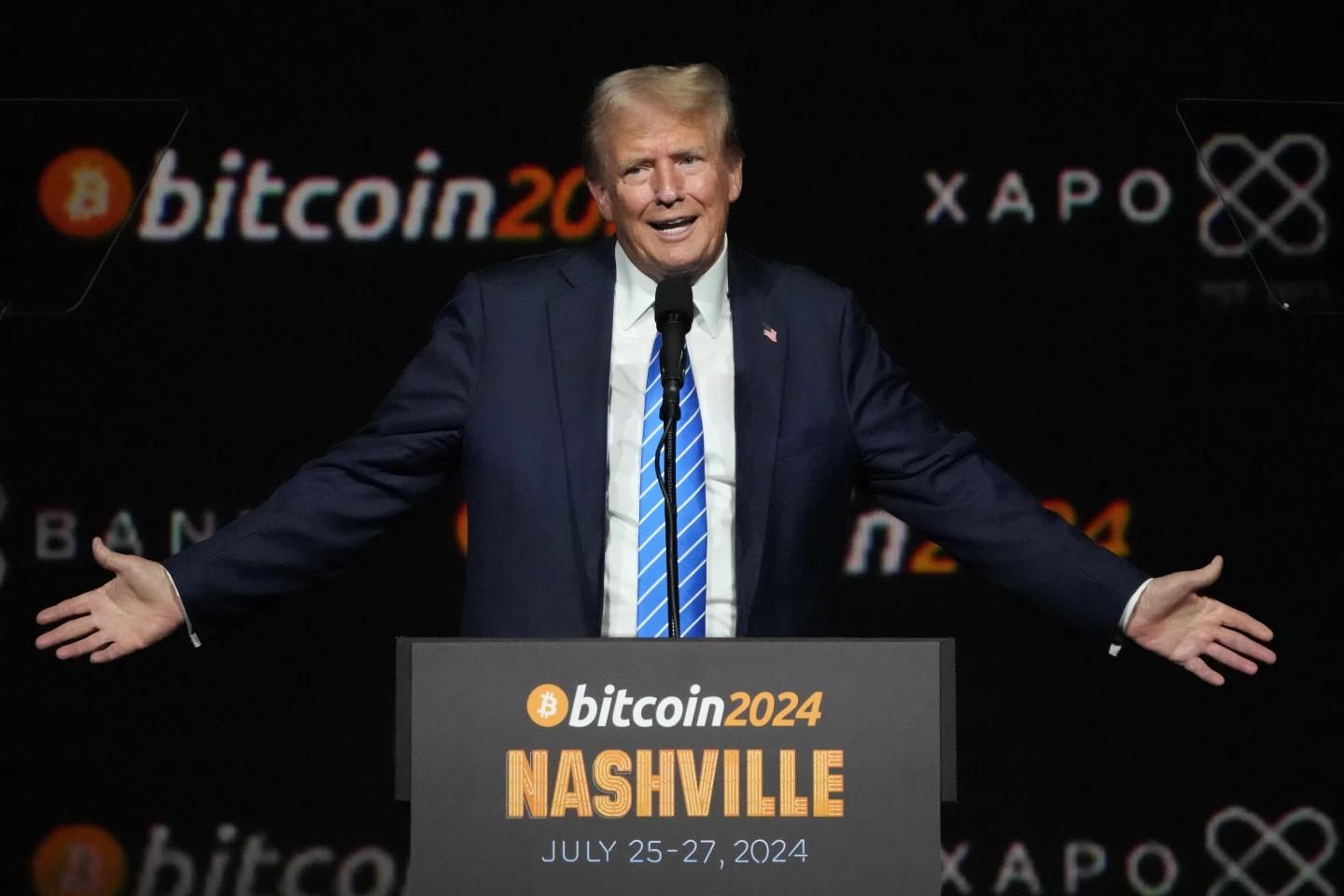

At a giant bitcoin conference over the summer, Trump made two key promises to his audience: First, he would fire Gary Gensler, the Securities and Exchange Commission chair and the industry’s arch nemesis. (Technically, the president can’t fire the SEC chair, though Gensler is widely expected to resign, as is customary when a new administration comes in.) And second: He would create a national bitcoin reserve by preventing the government from selling the assets it has seized in criminal cases.

The second promise from Trump was a bit vaguer, and it may well have been lip service to avoid being upstaged by Robert F. Kennedy Jr., who a day earlier pledged an even more ambitious “bitcoin Fort Knox” to make Uncle Sam the largest holder of bitcoin globally.

Either way, the result is effectively the same: The US government would backstop the price of bitcoin, an asset built on the idea that governments shouldn’t be able to manipulate currency values to suit their interests.

I asked several experts this week about that apparent inconsistency in the crypto ethos.

“Having the government establish a strategic reserve is completely incongruous with much of the ideological side, which is supposed to be about decentralization and antiauthoritarianism,” said Molly White, a journalist and prominent crypto skeptic. “But I think there is this belief among some cryptocurrency enthusiasts who say ‘Well, fine, it’s not really part of the ideology, but it makes the price go up.’”

The more generous take may be that, at this point, crypto’s only real use case is in creating value that can be traded and wagered on. Or, as Bloomberg’s Zeke Faux put it last week, “using real money to gamble on the prices of made-up coins.”

At a basic level, a strategic reserve “fully legitimizes bitcoin as an asset class with global systemic significance,” Yesha Yadav, a law professor and associate dean at Vanderbilt University, said in an email. “This, by itself, represents an enormous symbolic win for the crypto industry that two years ago was being spoken of as dead in the water.”

For more CNN news and newsletters create an account at CNN.com