加密货币行业,这个建立在让政府贪婪之手远离人民货币原则上的机构,正在蓬勃发展。原因是什么?他们可能终于说服政府接触比特币。 如您所见:比特币的价格,自15年前由计算机代码创造的OG数字资产,自选举日以来已上涨超过30%,屡次打破历史最高纪录,并在撰写本文时达到约92,000美元。自年初以来,价格已经翻倍,一些分析师预测到年底可能会达到100,000美元。 更广泛的股市也在上涨,华尔街松了一口气,因为美国选举结果比预期更快、更明确地出炉。但加密货币通常与股票一起波动,往往有更高的高点和更低的低点,这就是为什么人们喜欢在其上赌博。而本周,他们确实在赌博。 推动比特币涨势的热潮主要集中在对当选总统唐纳德·川普将推行亲加密政策的期待上,使这个多年来被主流投资者阶层忽视并遭到监管机构阻挠的行业获得合法性。 “我们所看到的涨势更多的是对加密领域市场动态正常化的反映,”Coinbase首席政策官Faryar Shirzad周二告诉我。“我认为我们所看到的是过去四年中我们面临的政治逆风抑制了加密市场的真实、现场示范。” 川普在2021年曾表示加密货币“看起来像是一场骗局”,但今年早些时候对该行业做出了180度的转变,这一明显的心态变化恰逢该行业从2022年的灾难性回落中反弹(部分原因是加密交易所FTX的崩溃以及其曾经高飞的创始人山姆·班克曼-弗里德的刑事起诉)。这一回升的一部分涉及Coinbase主导的政治动员,以及数千万美元的加密利润被投入到全国各地的各种竞选中,使其成为2024年选举周期中最大支出行业。 在夏季的一个大型比特币会议上,川普向他的观众做出了两个关键承诺:首先,他将解雇证券交易委员会主席Gary Gensler,后者是该行业的死敌。(从技术上讲,总统无法解雇SEC主席,但Gensler被广泛预期会辞职,这在新政府上任时是惯例。)其次:他将通过防止政府出售其在刑事案件中查获的资产来创建一个国家比特币储备。 川普的第二个承诺有点模糊,也可能只是口头上的,以避免被罗伯特·F·甘迺迪(Robert F. Kennedy Jr.)抢风头,他在前一天承诺建立一个更雄心勃勃的“比特币金库”,使美国成为全球最大的比特币持有者。 无论如何,结果基本上是相同的:美国政府将支持比特币价格,而这一资产建立在政府不应操纵货币价值以适应其利益的理念之上。 记者本周询问了几位专家关于这种明显与加密精神不一致之处。 “让政府建立战略储备与许多意识形态方面完全不相容,而这些意识形态应该是关于去中心化和反权威主义,”记者和知名加密怀疑论者Molly White说。“但我认为一些加密货币爱好者认为‘好吧,这不是真的意识形态的一部分,但它让价格上升。’” 更慷慨的看法可能是,在此时,加密货币唯一真正的用例是在创造可以进行交易和赌博的价值。或者正如彭博社的Zeke Faux上周所说,“用真实货币赌博虚构硬币价格。” 从基本层面来看,“战略储备完全使比特币作为一个具有全球系统意义的资产类别合法化,”范德堡大学法律教授兼副院长Yesha Yadav在电子邮件中表示。“这本身就代表了对于两年前被认为已经死去的加密行业而言,一个巨大的象征性胜利。”

加密货币行业,这个建立在让政府贪婪之手远离人民货币原则上的机构,正在蓬勃发展。原因是什么?他们可能终于说服政府接触比特币。 如您所见:比特币的价格,自15年前由计算机代码创造的OG数字资产,自选举日以来已上涨超过30%,屡次打破历史最高纪录,并在撰写本文时达到约92,000美元。自年初以来,价格已经翻倍,一些分析师预测到年底可能会达到100,000美元。 更广泛的股市也在上涨,华尔街松了一口气,因为美国选举结果比预期更快、更明确地出炉。但加密货币通常与股票一起波动,往往有更高的高点和更低的低点,这就是为什么人们喜欢在其上赌博。而本周,他们确实在赌博。 推动比特币涨势的热潮主要集中在对当选总统唐纳德·川普将推行亲加密政策的期待上,使这个多年来被主流投资者阶层忽视并遭到监管机构阻挠的行业获得合法性。 “我们所看到的涨势更多的是对加密领域市场动态正常化的反映,”Coinbase首席政策官Faryar Shirzad周二告诉我。“我认为我们所看到的是过去四年中我们面临的政治逆风抑制了加密市场的真实、现场示范。” 川普在2021年曾表示加密货币“看起来像是一场骗局”,但今年早些时候对该行业做出了180度的转变,这一明显的心态变化恰逢该行业从2022年的灾难性回落中反弹(部分原因是加密交易所FTX的崩溃以及其曾经高飞的创始人山姆·班克曼-弗里德的刑事起诉)。这一回升的一部分涉及Coinbase主导的政治动员,以及数千万美元的加密利润被投入到全国各地的各种竞选中,使其成为2024年选举周期中最大支出行业。 在夏季的一个大型比特币会议上,川普向他的观众做出了两个关键承诺:首先,他将解雇证券交易委员会主席Gary Gensler,后者是该行业的死敌。(从技术上讲,总统无法解雇SEC主席,但Gensler被广泛预期会辞职,这在新政府上任时是惯例。)其次:他将通过防止政府出售其在刑事案件中查获的资产来创建一个国家比特币储备。 川普的第二个承诺有点模糊,也可能只是口头上的,以避免被罗伯特·F·甘迺迪(Robert F. Kennedy Jr.)抢风头,他在前一天承诺建立一个更雄心勃勃的“比特币金库”,使美国成为全球最大的比特币持有者。 无论如何,结果基本上是相同的:美国政府将支持比特币价格,而这一资产建立在政府不应操纵货币价值以适应其利益的理念之上。 记者本周询问了几位专家关于这种明显与加密精神不一致之处。 “让政府建立战略储备与许多意识形态方面完全不相容,而这些意识形态应该是关于去中心化和反权威主义,”记者和知名加密怀疑论者Molly White说。“但我认为一些加密货币爱好者认为‘好吧,这不是真的意识形态的一部分,但它让价格上升。’” 更慷慨的看法可能是,在此时,加密货币唯一真正的用例是在创造可以进行交易和赌博的价值。或者正如彭博社的Zeke Faux上周所说,“用真实货币赌博虚构硬币价格。” 从基本层面来看,“战略储备完全使比特币作为一个具有全球系统意义的资产类别合法化,”范德堡大学法律教授兼副院长Yesha Yadav在电子邮件中表示。“这本身就代表了对于两年前被认为已经死去的加密行业而言,一个巨大的象征性胜利。”

A version of this story appeared in CNN Business’ Nightcap newsletter.

The crypto industry, an institution founded on the principle of getting the government’s greedy hands off the people’s currency, is booming. The reason? They may have finally convinced the government to get its hands on bitcoin.

See here: The price of bitcoin, the OG digital asset created out of computer code 15 years ago, has shot up more than 30% since Election Day, repeatedly smashing its record high and peaking (as of this writing) at around $92,000. The price has more than doubled since the beginning of the year, and some analysts are projecting it could hit $100,000 by year-end.

The broader stock market is up, too, as Wall Street is breathing a sigh of a relief that the US election results came in faster and more decisively than expected. But crypto, which often moves in step with stocks, tends to have higher highs and lower lows, which is why people like to gamble on it. And boy are they gambling this week.

Much of the hype fueling bitcoin’s rally centers on expectations that President-elect Donald Trump will usher in a pro-crypto agenda, bestowing legitimacy on an industry that for years has been dismissed by the mainstream investor class and stonewalled by regulators.

“The rally that we’re seeing is more of a normalizing of what the market dynamic should be around the crypto sector,” Faryar Shirzad, chief policy officer at Coinbase, told me Tuesday. “I think what we’re seeing is a real, live demonstration of how much the political headwinds that we’ve been facing over the last four years have suppressed the crypto markets.”

Trump, who as recently as 2021 said crypto “seems like a scam,” did a 180 on the industry earlier this year, in an apparent change of heart that coincided with the sector’s rebound from its disastrous 2022 (marked in part by the collapse of crypto exchange FTX and the criminal prosecution of its once-high-flying founder, Sam Bankman-Fried). Part of that comeback involved a Coinbase-led political mobilization and tens of millions of dollars in crypto profits being funneled into various races around the country, making it the biggest-spending industry in the 2024 election cycle.

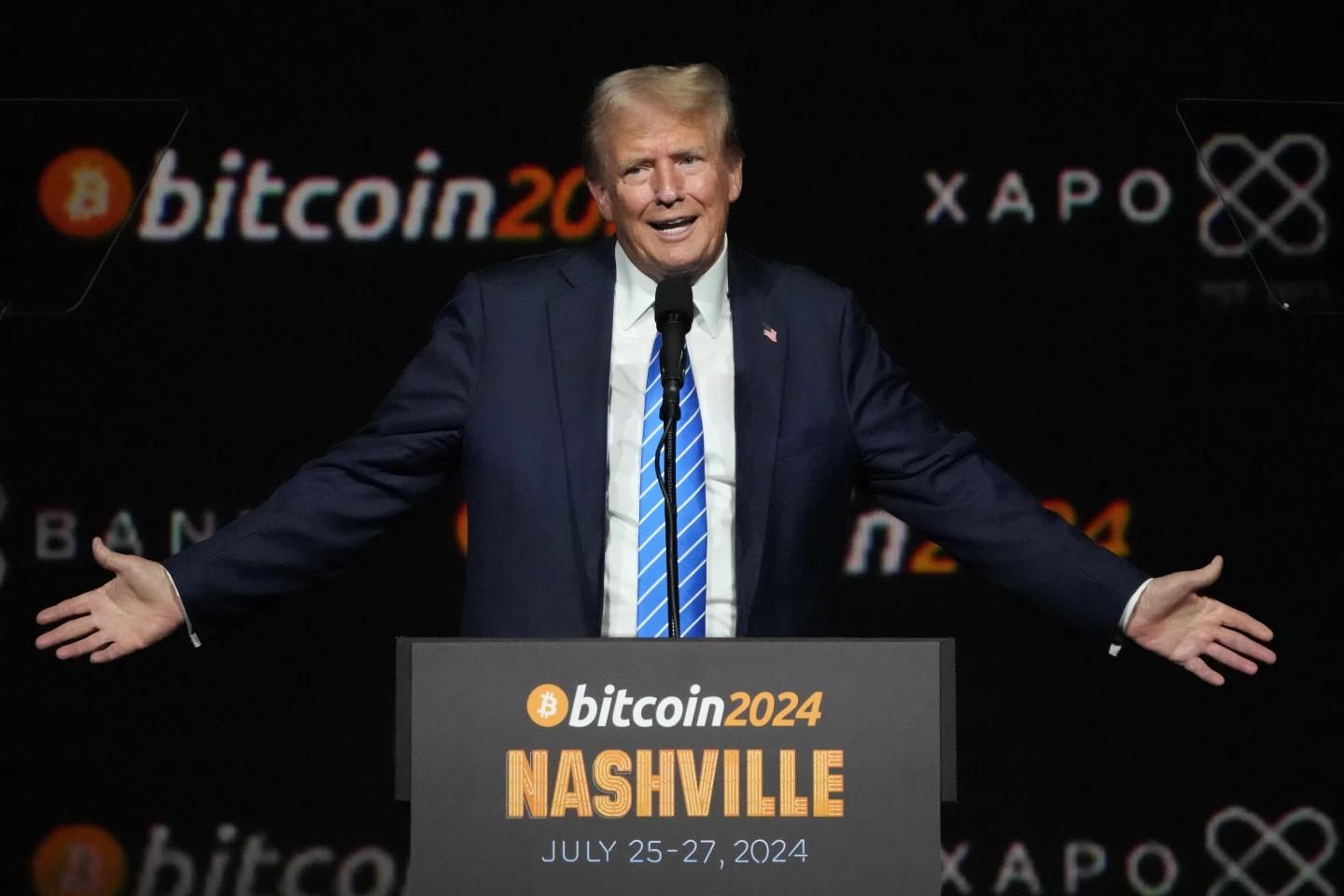

At a giant bitcoin conference over the summer, Trump made two key promises to his audience: First, he would fire Gary Gensler, the Securities and Exchange Commission chair and the industry’s arch nemesis. (Technically, the president can’t fire the SEC chair, though Gensler is widely expected to resign, as is customary when a new administration comes in.) And second: He would create a national bitcoin reserve by preventing the government from selling the assets it has seized in criminal cases.

The second promise from Trump was a bit vaguer, and it may well have been lip service to avoid being upstaged by Robert F. Kennedy Jr., who a day earlier pledged an even more ambitious “bitcoin Fort Knox” to make Uncle Sam the largest holder of bitcoin globally.

Either way, the result is effectively the same: The US government would backstop the price of bitcoin, an asset built on the idea that governments shouldn’t be able to manipulate currency values to suit their interests.

I asked several experts this week about that apparent inconsistency in the crypto ethos.

“Having the government establish a strategic reserve is completely incongruous with much of the ideological side, which is supposed to be about decentralization and antiauthoritarianism,” said Molly White, a journalist and prominent crypto skeptic. “But I think there is this belief among some cryptocurrency enthusiasts who say ‘Well, fine, it’s not really part of the ideology, but it makes the price go up.’”

The more generous take may be that, at this point, crypto’s only real use case is in creating value that can be traded and wagered on. Or, as Bloomberg’s Zeke Faux put it last week, “using real money to gamble on the prices of made-up coins.”

At a basic level, a strategic reserve “fully legitimizes bitcoin as an asset class with global systemic significance,” Yesha Yadav, a law professor and associate dean at Vanderbilt University, said in an email. “This, by itself, represents an enormous symbolic win for the crypto industry that two years ago was being spoken of as dead in the water.”

For more CNN news and newsletters create an account at CNN.com