川普当选总统后,包括特斯拉在内的加密货币和股票周一上涨,继上周下跌后上涨。 比特币价格创下超过 88,000 美元的历史新高,这一上涨是在川普被宣布赢得选举后不久开始的。自上周二美国选举日以来,这一数字较 68,000 美元有所上涨,涨幅为 27%。

与此同时,道琼工业指数在周一再次上涨 300 点后首次收于 44,000 点上方。一周后,在川普宣布参选后,该指数创下了多个历史新高。 道琼斯指数代表了大型银行等更成熟的公司,这些公司本身又迎来了强劲的交易日,因为投资者预计更有利的监管环境将导致并购活动增加。此类交易必然涉及大型金融公司的执行。 但不仅仅是规模较大的公司:涵盖估值较小的上市公司的罗素 2000 指数触及 2021 年以来的最高水平,收盘上涨 1.5%。 长期市场分析师埃德·亚德尼(Ed Yardeni)周一在一份报告中写道:“股票投资者…对政权更迭感到兴奋,政府将更加亲商,推动减税和放松管制。” 领涨的个股是特斯拉,上涨 9%。预计执行长马斯克将在川普第二任期内发挥重要作用。 由于预期电动车公司将受益于更有利的监管和政策环境,特斯拉股价自周二以来飙升近50%。根据 CNBC 报道,持有马斯克旗下 SpaceX 股份的专业投资工具 Destiny Tech100 基金自周二以来已上涨 200%。 在美国移民和海关执法局前代理局长汤姆·霍曼被任命为「边境沙皇」后,私人监狱公司的股价也大幅上涨。 Geo Group 的股价上涨了近 5%,自周二以来大约翻了一番,而 CoreCivic 的股价则上涨了近 7%。

Cryptocurrencies and stocks, including Tesla, rallied Monday, picking up where they left off last week in the wake of the President-elect Donald Trump's victory.

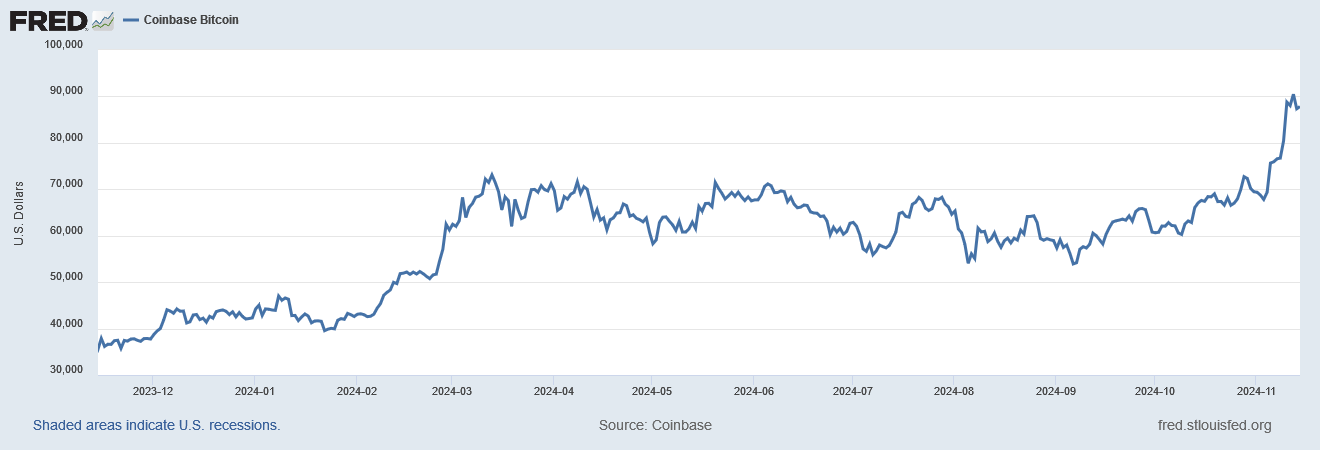

The price of bitcoin hit an all-time high of more than $88,000, a rally that started shortly after Trump was declared the winner of the election. That's up from $68,000 — a gain of 27% — just since last Tuesday, Election Day in the U.S.

Year to date, the price of bitcoin has nearly doubled.

Bitcoin price tracker

Shown here is how many U.S. Dollars one Bitcoin buys.

Meanwhile, the Dow Jones Industrial Average closed above 44,000 for the first time after it rose another 300 points Monday. That followed a week when it set multiple all-time highs after the race was called for Trump.

The Dow represents more established firms like large banks, which themselves had another strong trading day as investors anticipated that a more favorable regulatory environment will lead to an increase in merger and acquisition activity. Such deals necessarily involve tapping big financial firms to execute.

But it wasn't just larger firms: The Russell 2000 index, which covers publicly traded companies with smaller valuations, hit its highest level since 2021, finishing the day up 1.5%.

“Stock investors are ... thrilled by the regime change to a more pro-business administration promoting tax cuts and deregulation,” Ed Yardeni, a longtime market analyst, wrote in a note Monday.

Leading stocks higher was Tesla, which climbed 9%. CEO Elon Musk is expected to play an influential role in Trump's second term.

Tesla shares have soared nearly 50% since Tuesday on the expectation that the electric car company will benefit from a more favorable regulatory and policy environment. The Destiny Tech100 Fund, a specialized investment vehicle that holds shares of Musk's SpaceX, has climbed 200% since Tuesday, CNBC reported.

Shares in private prisons firms also saw significant gains after Tom Homan, the former acting director of U.S. Immigrations and Customs Enforcement, was named "border czar." Geo Group's stock was up nearly 5% — and it has approximately doubled since Tuesday — while CoreCivic's climbed nearly 7%.